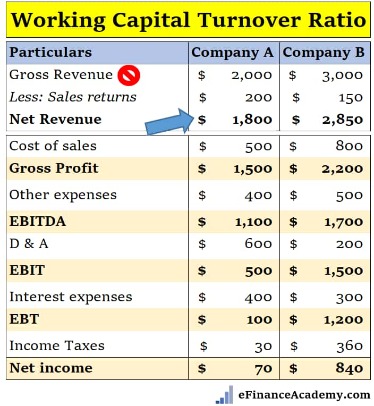

This is especially true if you’re expecting referrals to drive new business. You’re still spending $3,500 a month to stay in business, but last month you made $2,000. If the monthly cash sales were also considered, we would calculate the “net” variation. Given the amount of funding raised in the previous round, the $10mm, running out of cash in one year is considered fast. On average, the time between raising a Series B and Series C round ranges between ~15 to 18 months.

- Consider where you may be able to raise prices, increase average order value, or explore products that could be enhanced with new features to bring in more revenue.

- However, a controlled burn rate extends your runway, giving you more opportunities to pivot, test, invest, grow, and succeed.

- A firm with a positive cash flow usually has a lower burn rate, showcasing that it can manage its expenses efficiently and that its operations are financially stable.

- This will help you capture expenses and other outlays of cash that don’t occur monthly.

- The metric can help with managing resources, forecasting costs, and monitoring whether spending is within the budget, among other benefits.

Try bootstrap marketing

Finmark can help you keep track of each dollar going in and out of the business to be truly on top of your financials. Plus you can dive in to see exactly what’s eating away at your expenses and create scenarios to forecast what your growth will look like if you reduce certain expenses (or increase revenue). Net burn rate is the difference between cash out and cash in — the total amount of money lost during the month.

A Primer on Accrued Expenses (6 Examples)

It’s essential to track burn rate if your business is losing money, so you know how much longer you can keep operating without a profit, and plan how to grow your revenue in the future. Continuing with the previous example, if your startup also generated $20,000 in revenue during the month, your net burn rate would be $60,000 ($80,000 in total expenses minus $20,000 in revenue). Monthly burn rate what is the formula for determining burn rate isn’t just about the money being spent—it’s about where that money is going and ensuring it’s used to support your company’s long-term growth objectives. A company has no choice but to lower its structural costs by reducing what it is spending on staff, housing, marketing, and/or technology if its burn rate is too high. A company’s net burn rate is the total amount of money it loses each month.

- If you want to learn more about what burn rate is and why it matters to SaaS founders and investors, you’ve come to the right place.

- This involves keeping a close eye on your cash balance, cash reserves, operating expenses, overhead, and marketing costs.

- Net burn rate, on the other hand, tells you how much money you’re spending per month, but includes revenue in the equation.

- While it’s easy to assume that you need to reduce your burn rate, it’s not always necessary.

- This could be augmented with a trend analysis in addition to, or as a replacement for, monthly burn.

- A high burn rate before your company launches and starts selling a product is one thing, but once you start generating revenue, a high burn rate without any clear results means something must change, and fast.

- Moreover, dependence on additional funding can make a company vulnerable to shifts in the market or economy, as it may struggle to secure financing during periods of financial instability.

Sustainable Success: A Framework for Optimizing Profit

Review where your startup is spending money that is not essential to the operation and success of your startup and consider eliminating or reducing those expenses. Monitoring burn rate lets companies forecast cash needs and make capital decisions accordingly. A spiking burn rate may prompt cost-cutting or the need to raise more funds soon. A steady or declining burn rate suggests financial health and sustainability. Balancing burn rate is an important aspect of managing a company’s finances and growth.

A high burn rate dramatically shortens your runway, leaving less room for error or experimentation—it’s a quick-moving hourglass you don’t want to shake up. However, a controlled burn rate extends your runway, giving you more opportunities to pivot, test, invest, grow, and succeed. Based on the two data points gathered – the net losses of $1.5mm and $875k – we can estimate https://www.bookstime.com/ the implied cash runway. Upon dividing the $100,000 in cash by the $5,000 net burn, the implied runway is 20 months. Note, that there were no cash inflows in the example above – meaning, this is a pre-revenue start-up with a net burn that is equivalent to the gross burn. Suppose we’re tasked with calculating the burn rate of a SaaS startup using the following assumptions.

How Is the Burn Rate Calculated?

- She graduated from Florida State University with degrees in writing, business, and communications.

- The implied cash runway comes out to 7 months, which means that assuming no cash sales going forward, the start-up could continue to operate for 7 months before needing to raise financing.

- Expenses are the costs of doing business—anything that ensures a company’s ongoing operations and delivery of products or services.

- In some cases, a high burn rate could indicate aggressive growth strategies or inefficient use of resources.

- The Burn Rate is the rate at which a company spends its cash, most often used to analyze the spending of early-stage start-ups.

- This is a clear indicator that burn rate can fluctuate based on the size and age of your company.

It all depends on how you are allocating capital and how this impacts your startup. If your burn rate is high but you are effectively using capital to fuel future growth, this seems like good capital allocation. This means the startup is burning through $5,714 for every month of operations before they expect to reach positive cash balance.

How to Calculate Burn Rate

Raise Funds